- Budgeting

- Cash Management

- Consumer and Mortgage Loans

- Debt and Debt Reduction

- Time Value of Money 1: Present and Future Value

- Time Value of Money 2: Inflation, Real Returns, Annuities, and Amortized Loans

- Insurance 1: Basics

- Insurance 2: Life Insurance

- Insurance 3: Health, Long-term Care, and Disability Insurance

- Insurance 4: Auto, Homeowners, and Liability Insurance

- The Home Decision

- The Auto Decision

- Family 1: Money and Marriage

- Family 2: Teaching Children Financial Responsibility

- Family 3: Financing Children’s Education and Missions

- Investments A: Key Lessons of Investing

- Investments B: Key Lessons of Investing

Understand the Types of Term Life Insurance

How Term Insurance Works

Term insurance provides life insurance protection that is valid over a specific term or time period. It is pure death protection. After the specified period of time is over, the life insurance company is not required to continue coverage. The main advantage of this type of insurance is that it is the least expensive death-benefit coverage over the short term, as mortality costs rise with age.

However, this insurance may be disadvantageous because it is valid only if the insured dies during the term of coverage. Another disadvantage is that the cost of the insurance will increase with each new contract period because term insurance is basically the pure cost of mortality insurance at a specific age. Older individuals typically pay more for life insurance because the probability of death increases with age. The insurance contract may not be renewed once the current term expires (at the insurance company’s discretion) unless it contains a guaranteed renewable feature.

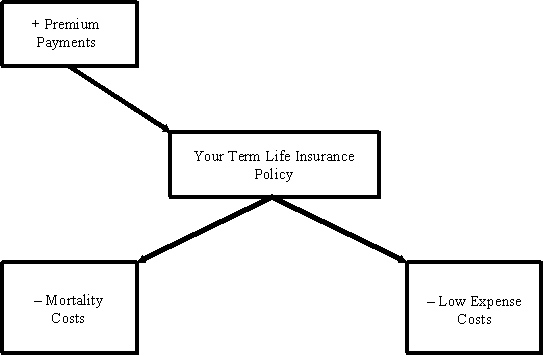

Figure 4 shows an example of a term policy. Premium payments are made on the term life insurance policy. These premium payments cover mortality costs and other fees. There is no buildup of cash—all premiums go to pay the costs and fees. As long as you continue making payments, you are covered for the contracted amount of time.

There are many different types of term insurance, the most common being level term, renewable term, decreasing term, convertible term, and increasing term.

With annual term insurance, the face or death benefit amount is constant through the selected term of coverage. Premiums increase each time the contract is renewed, even though the face amount remains the same. Coverage terminates after the specified time period.

Renewable term insurance can be renewed for a specific number of years. Even if health problems become apparent after coverage has begun, you are able to continue the coverage until the end of the specified period. Premiums at each renewal period are considerably higher, unless you demonstrate to the company that your health and circumstances merit a continued favorable rate.

In decreasing term insurance, premiums remain constant over the life of the term; however, the face amount (or the amount of coverage) decreases. This type of insurance would typically be used to cover a specific loss, such as a mortgage, where the principle is declining each year, or the reducing number of years of a child’s dependency as the child grows older.

Convertible term insurance is a policy that can be exchanged for a cash-value policy within a specific number of years after issuance without evidence of insurability. Many term policies contain this specific guarantee. These convertible term insurance policies allow you to convert your term policy to a cash-value policy at your discretion, regardless of your medical history; you also do not have to get a medical exam to convert your policy.

Premiums on term policies are much less than permanent policies with similar death benefits for three main reasons. First, with term policies, you are only paying for insurance for a specific period; in other words, the risk is priced one period at a time. Roughly 98 percent of all term policies lapse without payment. Second, generally term insurance is priced for shorter time periods from one to twenty years. The longer the time period, the more insurance companies must charge higher fees in the early years to offset the more expensive mortality charges and fees in the later years. Finally, term insurance policies are less complex than permanent products and are cheaper and easier to administer.

There are a number of important questions that should be answered before you purchase term insurance. These questions include the following:

- What is the premium?

- How long can I keep this policy?

- What are the renewal terms of the contract?

- When will my premiums increase?

- Can I convert my term policy to a permanent or cash policy? Can I convert it without getting a medical exam? What are the details?

- How strong is the insurance company financially?

Figure 4