- Tax Planning

- Investments 1: Before you Invest

- Investments 2: Your Investment Plan

- Investments 3: Securities Market Basics

- Investments 4: Bond Basics

- Investments 5: Stock Basics

- Investments 6: Mutual Fund Basics

- Investments 7: Building Your Portfolio

- Investments 8: Picking Financial Assets

- Investments 9: Portfolio Rebalancing and Reporting

- Retirement 1: Basics

- Retirement 2: Social Security

- Retirement 3: Employer Qualified Plans

- Retirement 4: Individual and Small Business Plans

- Estate Planning Basics

Understand How to Buy and Sell Securities

A broker is an intermediary between buyers and sellers of stock. An investor places orders with brokers, either indirectly by phone or fax, or directly through the Internet. The broker takes the orders to the securities exchange. If the broker is successful in finding a counter-party to the trade (i.e. a buyer is found when you want to sell a security) or a seller is found when you want to buy a security, the trade is executed on the exchange. The broker then notifies the investor that the trade has been made, and funds and securities are exchanged on the specified trade date (See Chart 20.1).

Chart 20.1 The Trading Process for Stocks

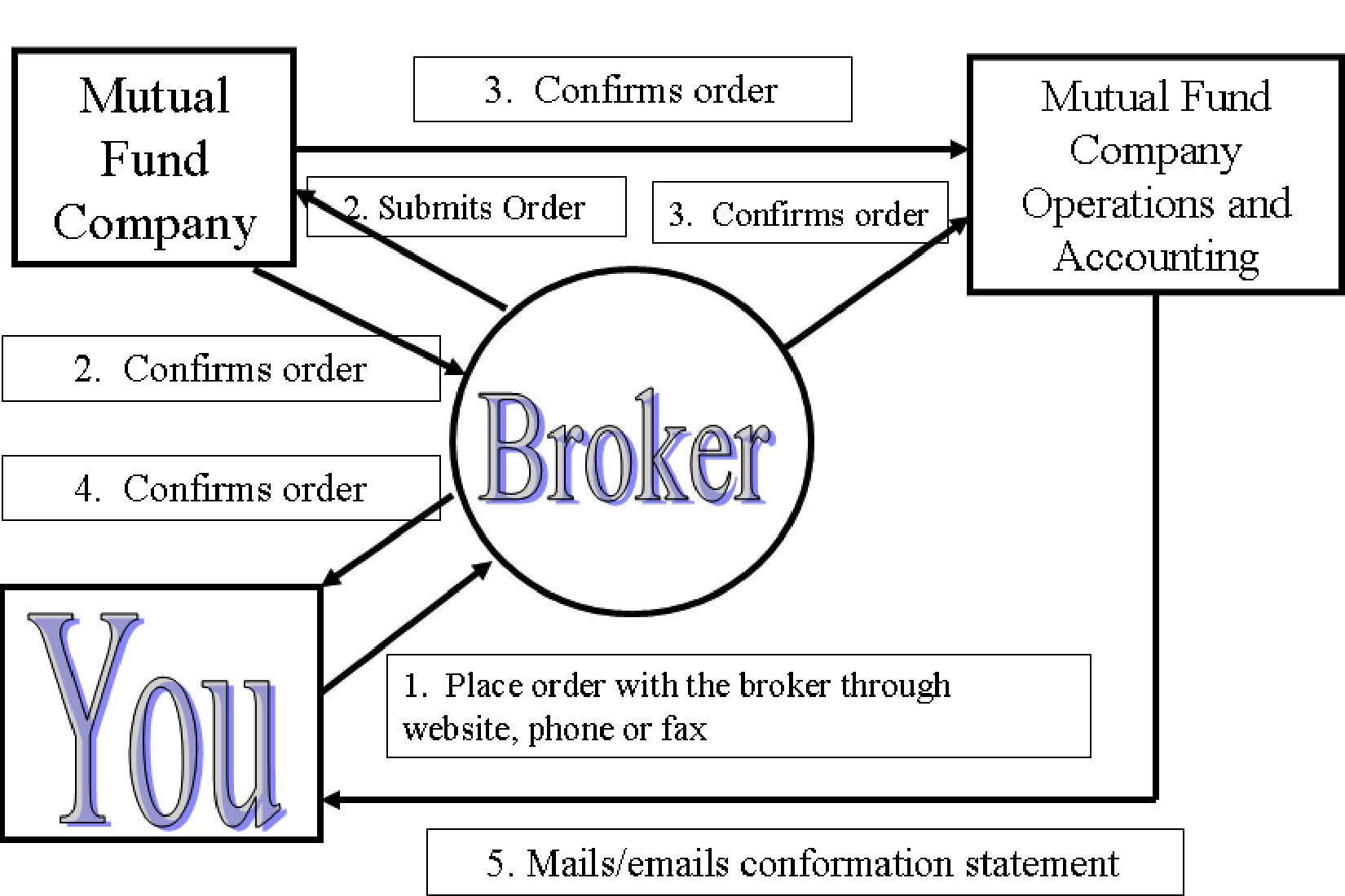

Chart 20.2 The Trading Process for Mutual Funds with a Sales Charge

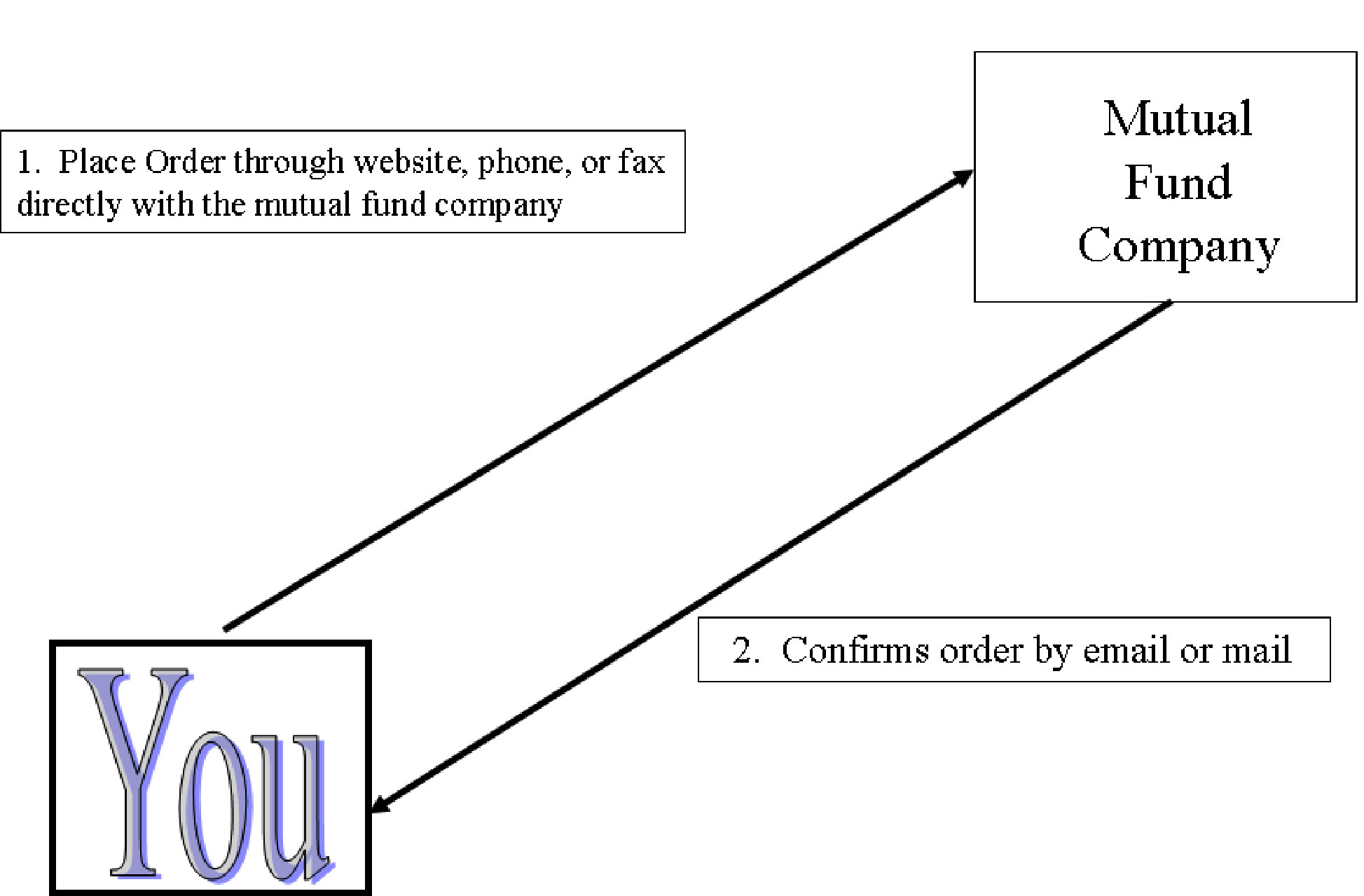

Chart 20.2 The Trading Process for No-Load Mutual Funds