- Budgeting

- Cash Management

- Consumer and Mortgage Loans

- Debt and Debt Reduction

- Time Value of Money 1: Present and Future Value

- Time Value of Money 2: Inflation, Real Returns, Annuities, and Amortized Loans

- Insurance 1: Basics

- Insurance 2: Life Insurance

- Insurance 3: Health, Long-term Care, and Disability Insurance

- Insurance 4: Auto, Homeowners, and Liability Insurance

- The Home Decision

- The Auto Decision

- Family 1: Money and Marriage

- Family 2: Teaching Children Financial Responsibility

- Family 3: Financing Children’s Education and Missions

- Investments A: Key Lessons of Investing

- Investments B: Key Lessons of Investing

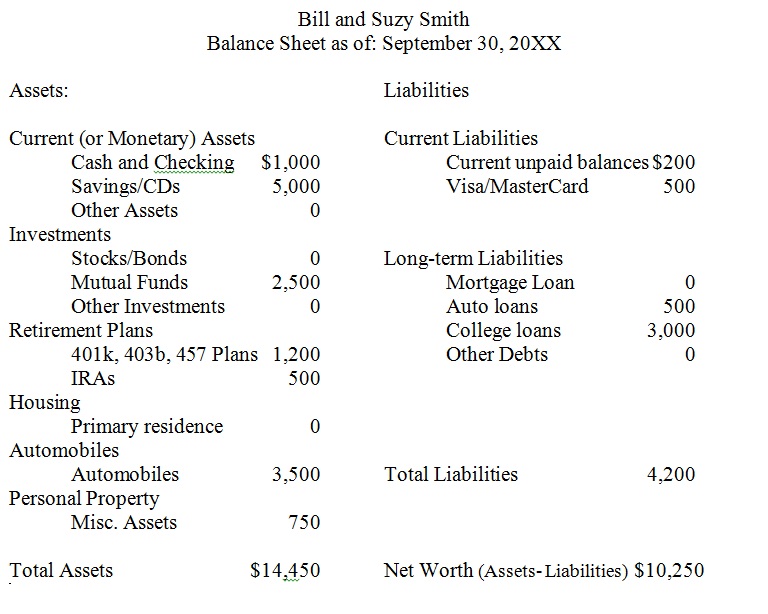

Calculate Your Net Worth Using a Personal Balance Sheet

The second thing you must do to determine where you are financially is to calculate your net worth using a personal balance sheet. A personal balance sheet is one of a number of financial reports commonly referred to as financial statements.

A personal balance sheet is a snapshot of your financial position on a given date, usually the end of a month or year. It lists the dollar amounts of your liabilities (what you owe to others) and your assets (what you own of monetary value).

How do you calculate your net worth? Your net worth (also referred to as equity) is the difference between your assets and your liabilities.

Because of the many different types of assets and liabilities, there are multiple ways to appraise each type of asset or liability. Calculate the value of each asset or liability correctly, because if you do not, you will have an incorrect view of your financial position. Having an incorrect view of your financial position may result in your making bad financial decisions.

An example of a balance sheet is found in Chart 5. In addition, an example of a balance sheet template (Learning Tool 4: Budget, Balance Sheet, and Financial Statements Worksheet) can be found in the Learning Tools section of this series.